By Beth Braverman | From Folio

The last decade has seen massive shifts in magazine media, in part due to digital publishing startups that are competing by creating innovative (and cheap) products that aim to stay a step ahead of ongoing disruptive forces. Worse, the rise and scale of the duopoly has left most publishers fighting for virtual table scraps.

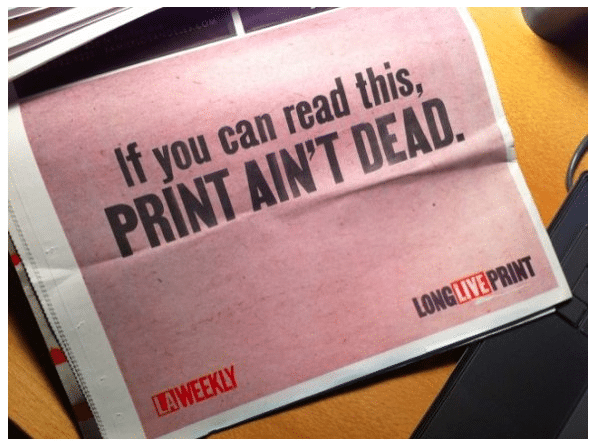

Many content producers responded aggressively with a (often ill-advised) “pivot to video,” while others are leaning more on social channels, where the rules continue to change. Still, despite the perception by some that print is dying and digital is the only way to survive and thrive, there are publishers who still recognize value in print.

After all, print continues to generate the largest chunk of revenue for most legacy publishers. Print advertising accounted for 62 percent of the $16.6 billion in magazine advertising revenue in fiscal year 2016, according to PwC’s most recent research, and 87 percent of circulation revenue came from print products.

“We see it as print and digital; not print or digital,”

says Jon Werther, president of Meredith’s National Media Group.

At Meredith, print revenue accounted for two-thirds of overall advertising revenue, and circulation represented 30 percent of revenue in 2017, making it the company’s second-largest revenue stream.

“The old trope that print is dead is just lazy thinking,”

says Linda Thomas Brooks, president and CEO of the MPA—the Association of Magazine Media.

While many ad dollars that were previously allocated to print will almost definitely not bounce back to pre-recession (and pre-mobile) totals, brands still want to invest in print campaigns, and continue to believe in the power of the medium to get their message across.

“There is so much innovation that you can still bring to the magazine part of the business,” says Chris Mitchell, chief business officer for the Condé Nast Culture Collection. “For a while we were so focused on innovation equaling digital that we as an industry didn’t put quite enough of our brain power into how we could integrate the businesses and the delivery of magazines.”

The Data Play

The ability to use big data to prove the value of print advertising has become even more important as publishers find themselves competing with data-rich digital rivals. Print publishers have responded with hard numbers of their own. Meredith, for example, uses the Meredith Sales Guarantee to measure and guarantee the incremental sales impact of advertising in print, digital and cross-platform. In every case, advertisers have seen a positive ROI and increase in sales, and the company plans to roll out the program to cover it’s recently-acquired Time Inc assets, Werther says.

Bauer Media—where more than three-quarters of revenue comes from print—uses GFK MRI’s Starch research data to show advertisers how it can help them meet their marketing goals.

“Because readers are making an active purchase decision the day they read the magazine, we provide outsize reader engagement that we can very convincingly demonstrate with third-party data,” says Steven Kotok CEO of Bauer Media Group USA. “And because our readers are retail shoppers who encounter and purchase our products in a retail environment, we are uniquely able to activate retail consumer purchases.”